Verify customers within

seconds to streamline

your onboarding process

Video KYC for Smooth

Customer Onboarding

KYC expert assisted remote customer

verification with robust liveness detection

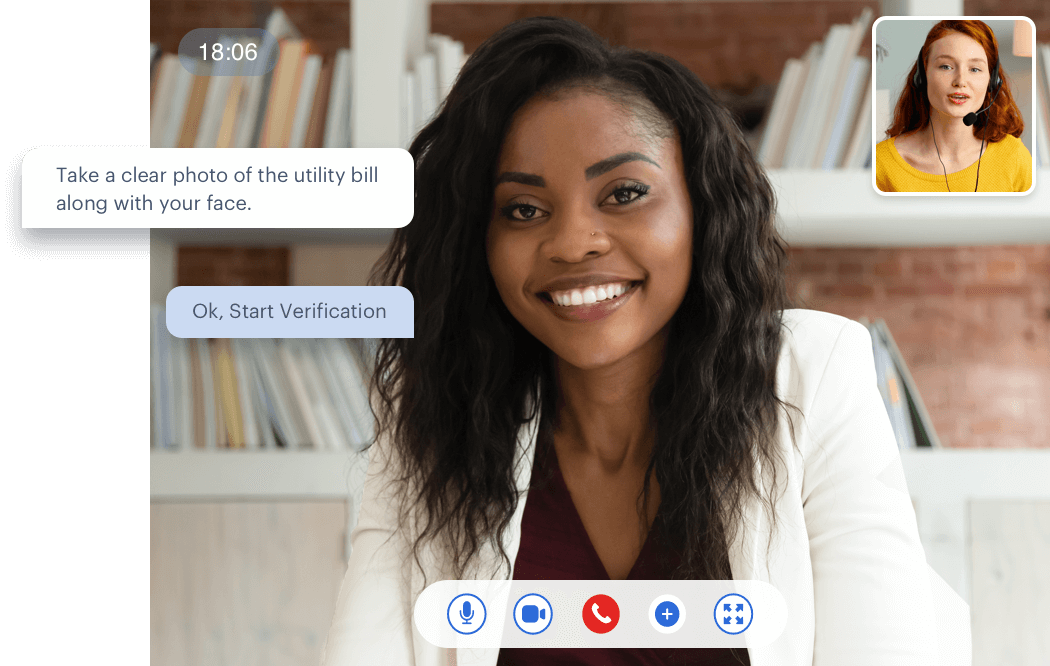

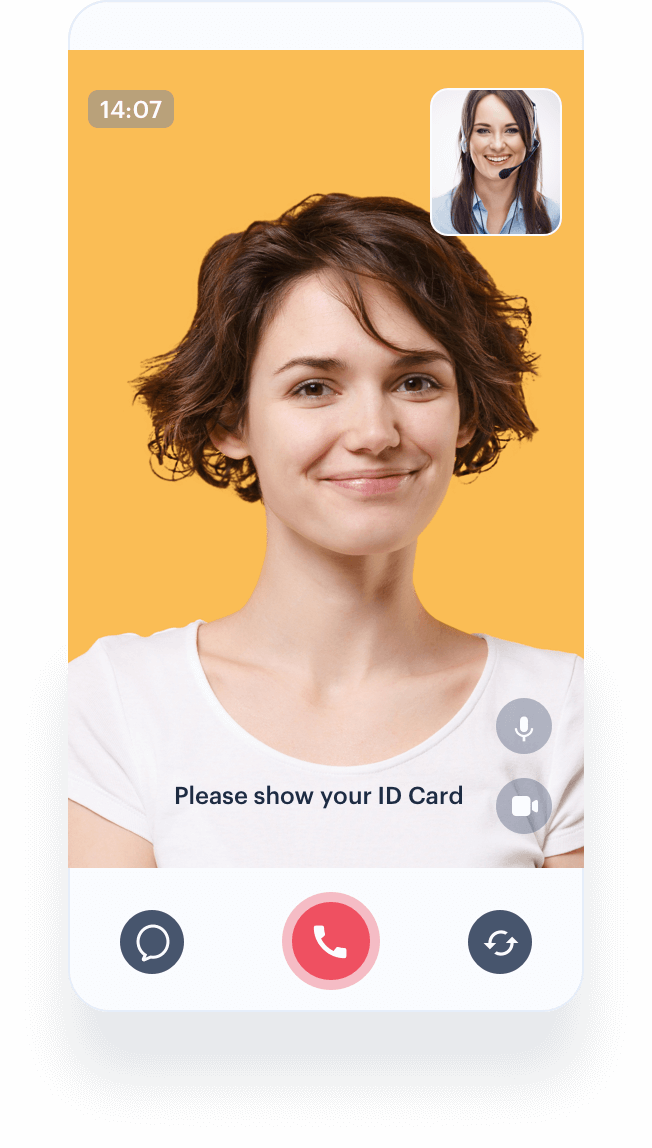

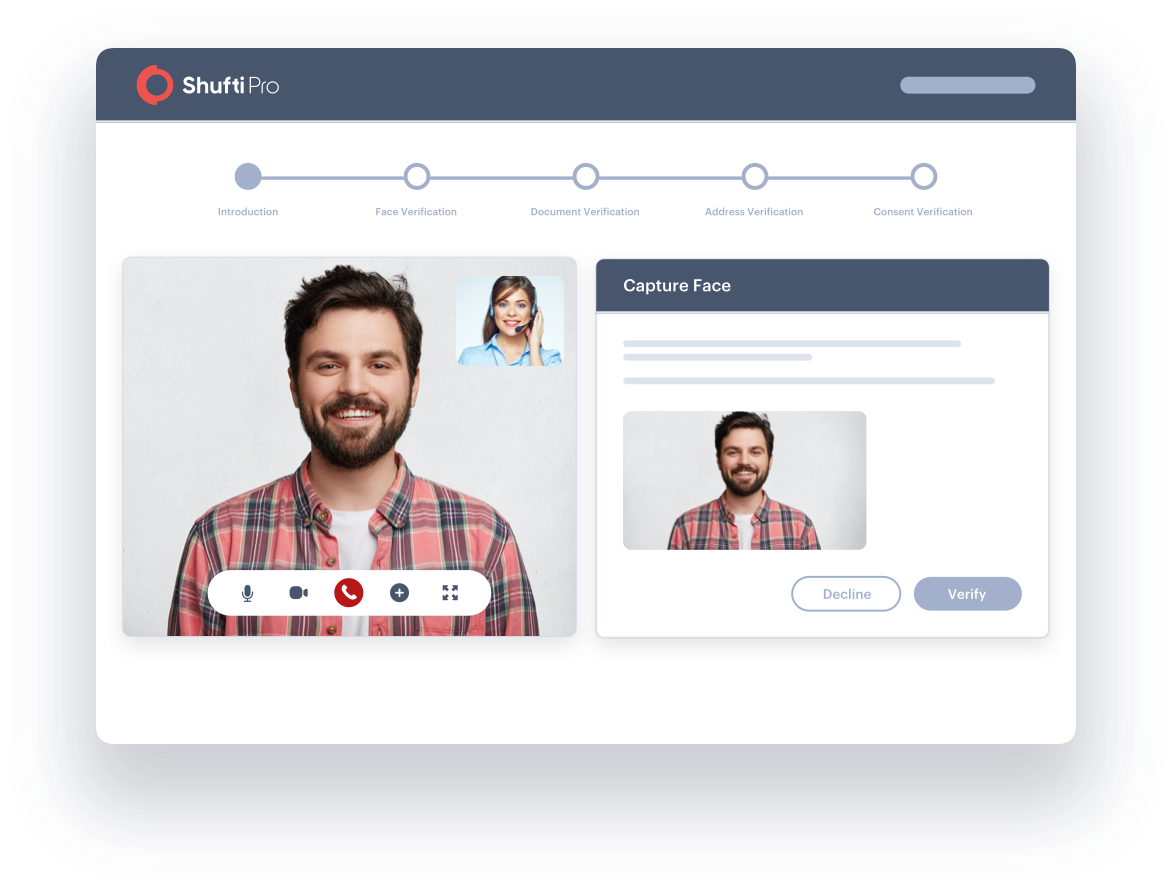

Customer gets on the live video

call with a KYC expert after

signing up on the platform

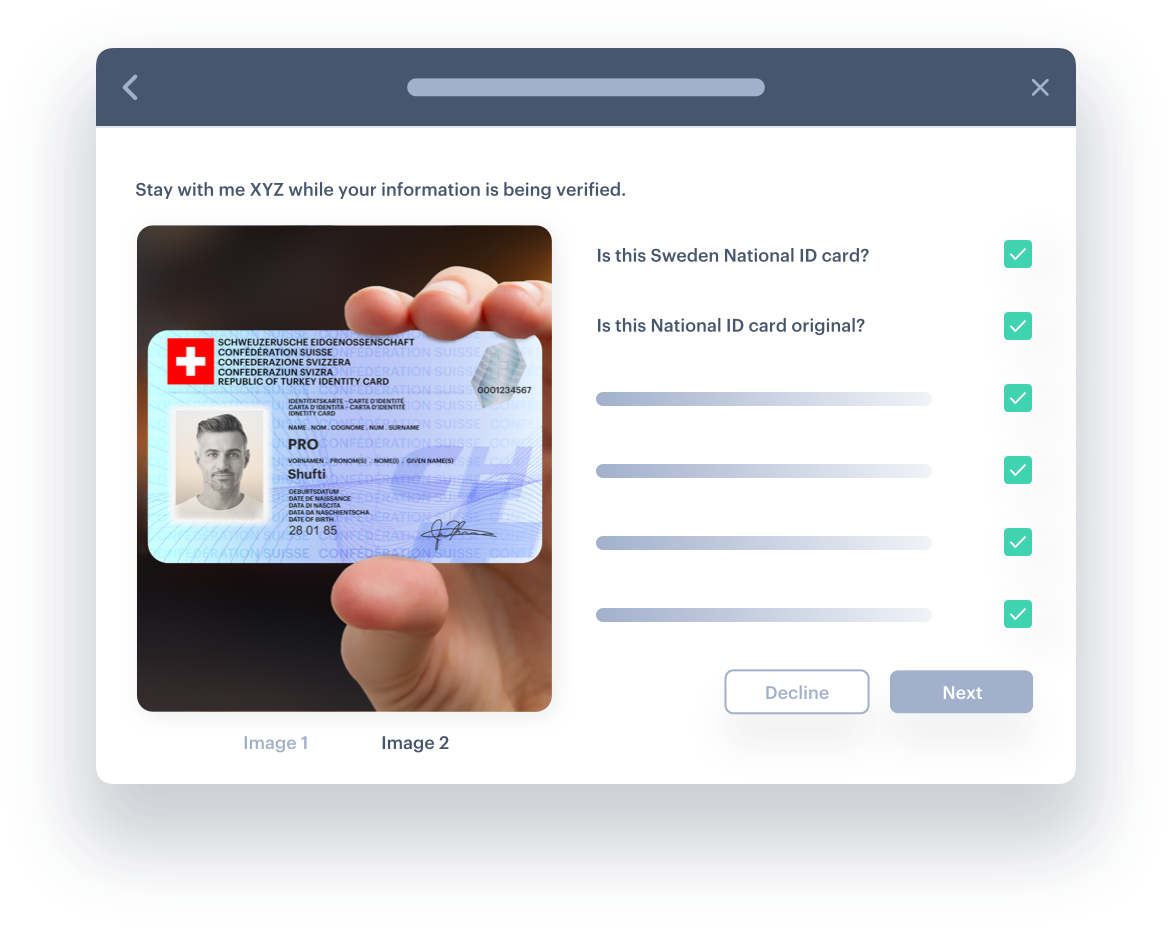

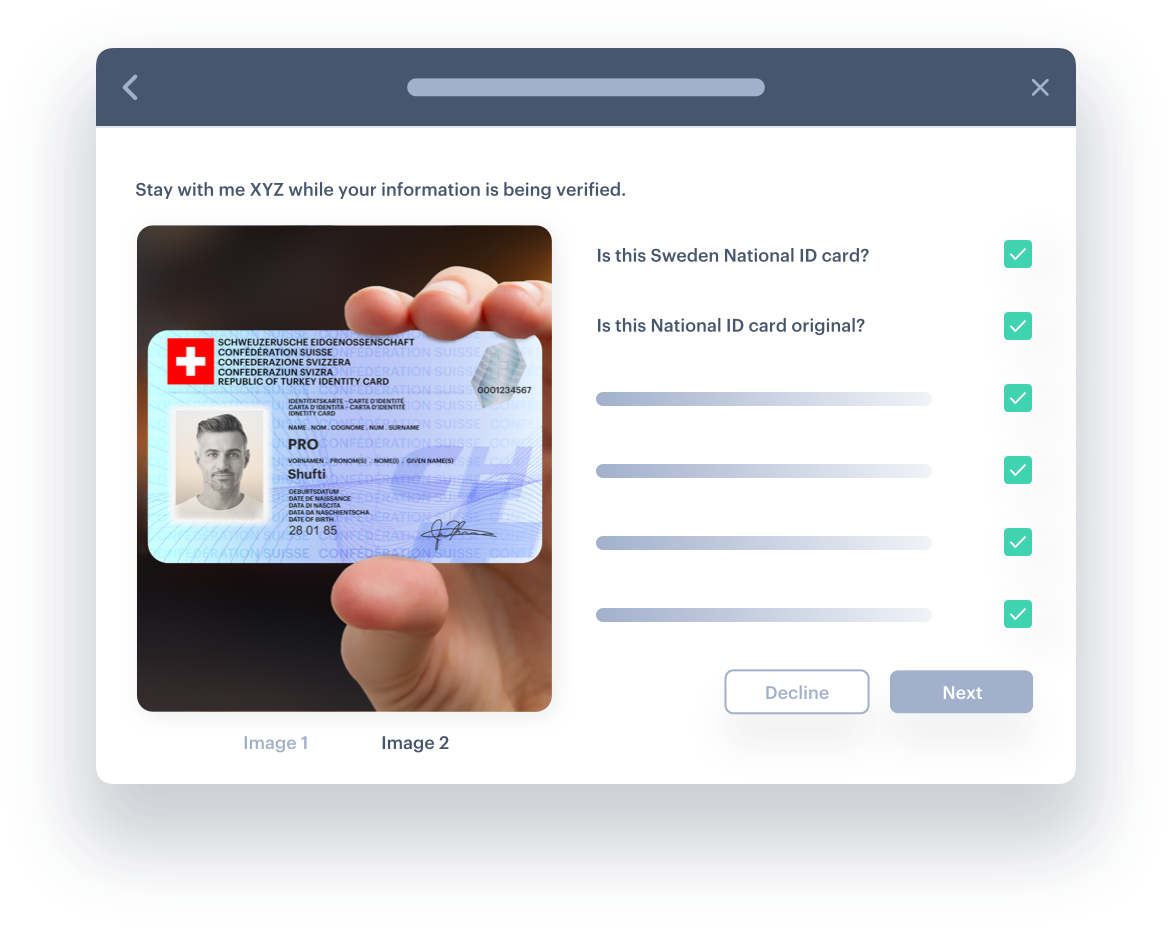

The KYC expert interviews the

Customer for liveness detection

through facial recognition techniques

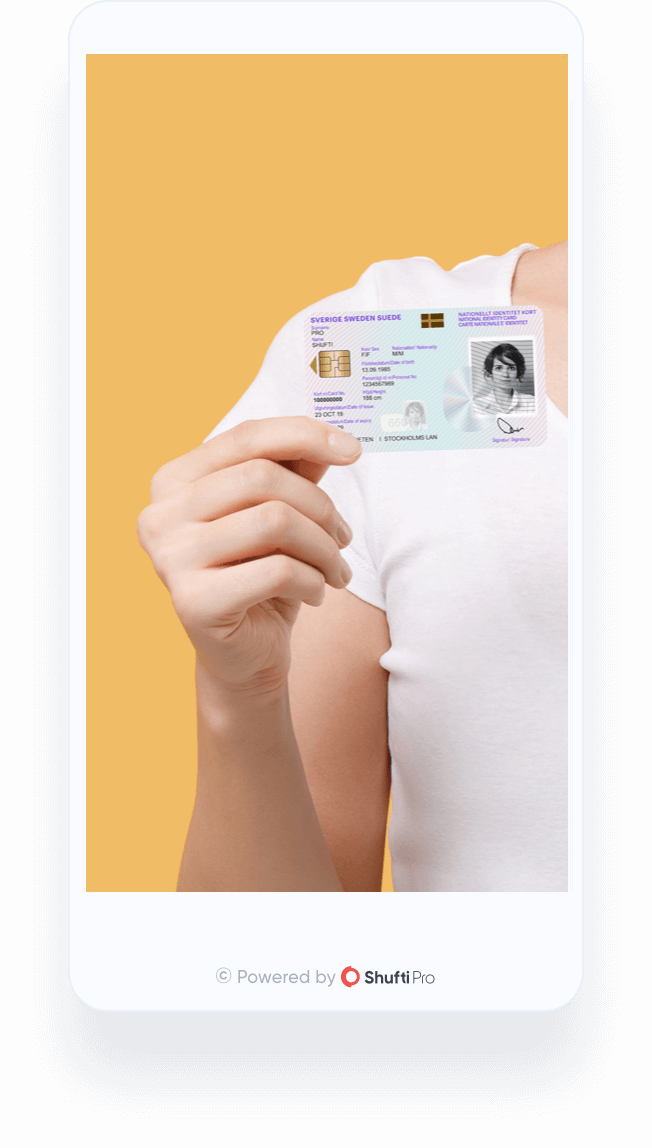

Customer is asked to show their

identity document in front of

the camera in real-time

The Customer face is matched

with the face on ID document

for identification

Customer gets on the live video

call with a KYC expert after

signing up on the platform

The KYC expert interviews the

Customer for liveness detection

through facial recognition techniques

Customer is asked to show their

identity document in front of

the camera in real-time

Video KYC for Banks

and Online Businesses

Expedite your customer verification process to

meet KYC/ AML compliance regulations

Contactless Verification

Fast customer verification without

the need for physical presence

Anti-Spoofing

Forged and tampered ID documents

are detected using AI/ML models

Geolocation

The location is verified along with

the customer IP address for

additional security

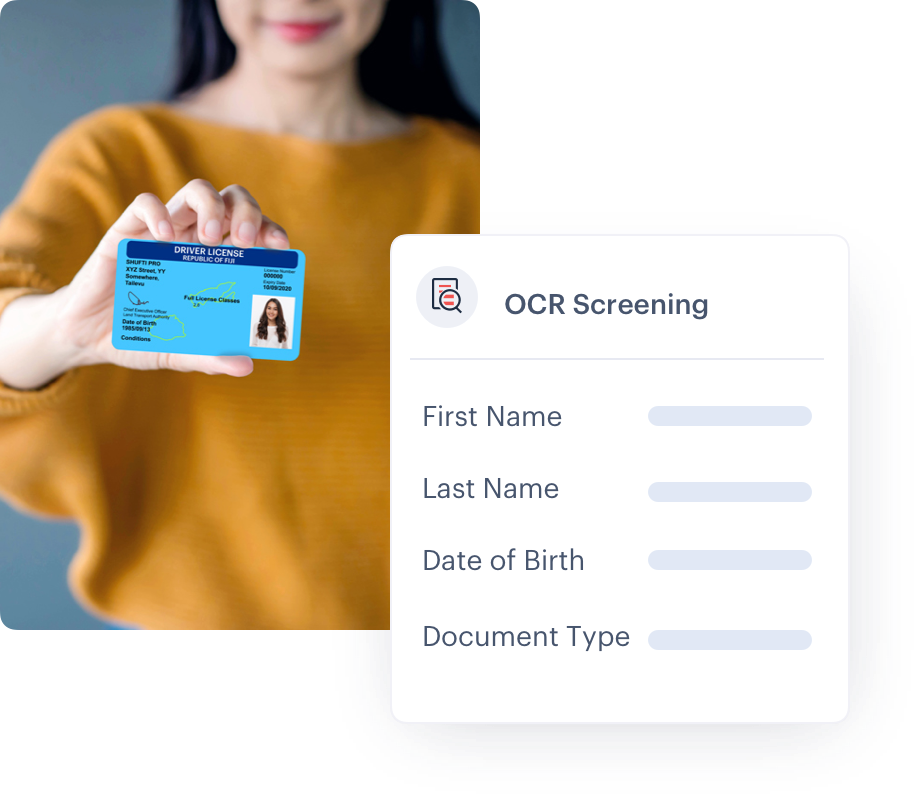

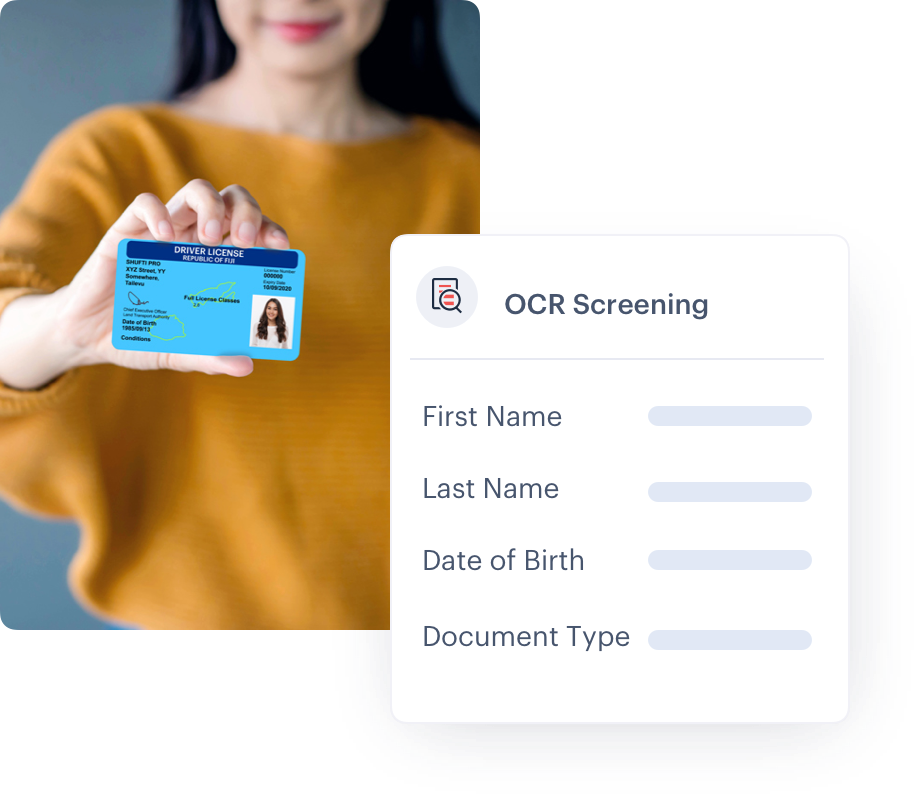

Real-time Data

Extraction

Data is extracted from identity

documents using OCR technology

Liveness Detection

Facial recognition techniques

are applied to prevent facial

spoof attacks

Powerful Security

Measures

The video verification uses strong

security protocols and is tightly

secured with end-to-end encryption

Explore the Significance

of Video KYC for the

Fintech Industry

Shufti Pro’s Three

Video KYC Models

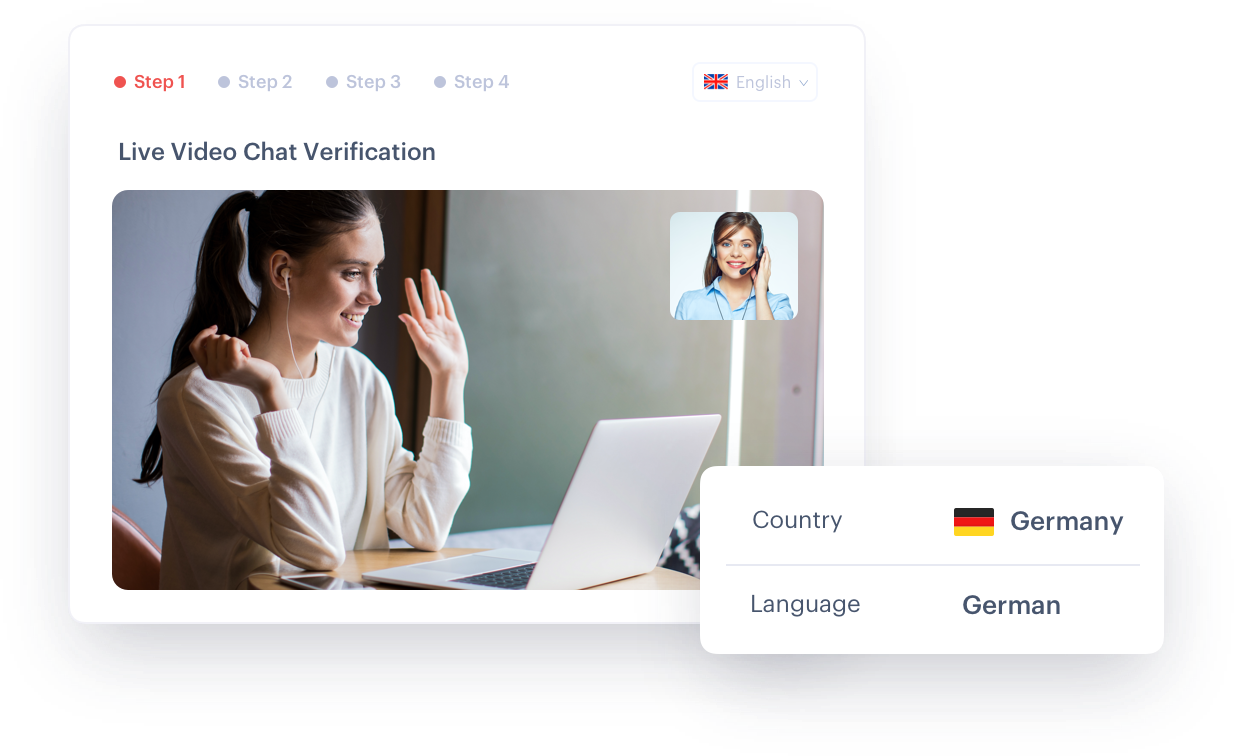

Regional KYC Experts

Choose the language and nationality

of your human verification expert to

give a customized experience to

your customers

Use Your Own

KYC Experts

Your KYC experts use Shufti Pro’s

identity verification solution to perform

a seamless video verification process

Automated AI-Based

Instructions

AI-supported chat with the end-

user in real-time followed by OCR

screening of identity documents

Check Customer’s

- ID Card

- Liveness

- Original Documents

- Background

Smooth Customer

Video Identification

- Live video Interaction with agent

- Liveness check through facial recognition

- Present original ID documents

for proof of address - Present a written consent note to

proceed further - Get verified

Financial Institutions Spend

upto $500 Million Per Year

on KYC Processes

Shufti Pro’s Video identification solution reduces

customer onboarding costs by 80%. Choose the

video KYC model to meet your business needs.

Video KYC Solution

for Global Industries

Either it’s remote employee onboarding video KYC

or customer age verification video, Shufti Pro’s

VideoID solution has got you covered.

Banks & Financial

Institutions

Insurance Firms

Payment Industry

Blockchain

P2P

Lending & Leasing

Companies

Banks & Financial

Institutions

Insurance Firms

P2P

Payment Industry

Blockchain

Lending & Leasing

Companies

Perks of Choosing Our

Video KYC Solution

High Assurance

Identification

Video KYC ensures foolproof

security against deep fakes

and synthetic identities and

enhanced document

authentication is performed

using AI models.

No Need to Hire

KYC Experts

Our KYC experts are

experienced in cross-

checking global identity

documents and for

providing real-time

interaction with end-users.

Smart Regulatory

Compliance

In-sync with changing KYC

and AML requirements,

making it easier to comply

with guidelines for video

verification of customers.

Cost-effective

Solution

Offering a cost-effective

solution for streamlining

customer onboarding and

reducing drop-off rates.

Countries meeting KYC

compliance with videoID

Video KYC is allowed in some countries worldwide for

secure customer onboarding and remote verification.

Countries around the globe are integrating video

verification solutions into their systems every day.

Many European and Non-European member states are

embracing video KYC to deter the growing risks of

fraud and financial crimes. While some states are still in

the process of implementing laws to allow video KYC.

The need for video verification is growing among

industries owing to digitisation and remote

customer onboarding, therefore, in due time video

KYC will replace manual authentication procedures

for accurate verification across borders.

-

Your one-stop solution to verify customers wherever they are in the world

- Contact Us