Carry out Identify Verification

within 30-60 seconds to meet KYC/AML Compliance

Are you sure your clients are who they claim to be? What if they are blacklisted by the regulatory authorities due to financial crime? Prevent Online Fraud using Shufti Pro’s proficient Digital KYC and AML screening services.

Identity Verification

Verify Anyone, Anytime, Anywhere

Face Verification

Verifying end-users selfies and short video clips to detect the liveliness of the user through AI and ML.

Ensuring the remote presence of an individual through

- 3D Depth Analysis

- Texture Analysis

- Identifying Print Attack

- Identifying Replay/Video Attack

Document Verification

To authenticate identity documents ensuring the legitimate residency of an individual in a country.

With the extensive support of over 1000 ID templates, documents are checked against:

- Tampered/ Photoshoped Elements

- Format Accuracy

- Crumpled/Folded Documents

- MRZ Code Authentication

Address Verification

To check the location of an individual against the physical address on an identity document ensuring the legal residency of individual.

Establishing a connection between the remote and physical address of an individual through:

- Identity Cards

- Utility Bills

- Bank Statements

- Credit/Debit Card Bills

2-Factor Authentication

Making sure that only authorized individual is accessing the system, not a bot or fraudster. Also, preventing theft of an individual’s information through phishing emails or spoofing attacks by sending a security code on the user’s phone.

AML screening

Verification against WorldWatch sanctions lists and PEPs to check the legal status of a person. In case of involvement with any financial crime or risky background, the individual is filtered out.

- 1000+ Sanctions List

- 1000+ Databases

- Database Updated Every 15 Minutes

- Adherence to Global AML Compliance

Avail top of the Line KYC Compliance and AML

Screening Solutions to Eliminate Online Frauds and

Digital Scams

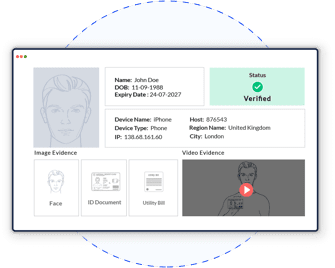

KYC Compliance in 30-60 seconds

Face Verification

Show your face to

the camera

ID Verification

Show the documents

to the camera

Results

Check your complete

status along with reasons

Why Choose Shufti Pro?

Time Efficient

Real-time verification in just

30-60 seconds

Global Coverage

100+ document formats supporting

150+ languages

Proof of Identification

Intuitive report at the end of

the verification

Huge Databank

Data from 1000+ watchlists and

1000+ databases which is

updated every 14 minutes

Easy Integration

Integrate with your existing

processes on any device

Global Compliance

Adhering to KYC, AML and GDPR

compliances set by financial

watchdogs and international

regulators

Reliable KYC and AML

Solutions for Every Industry

- Customized digital KYC as per need of business

- Banks

- Financial Institutions

- Real Estate

- eCommerce

- Health Industry

- Insurance

- Online Gaming

- P2P Economy